All You Need to Know as a Mitosis LP

July 09, 2024

|

Blog

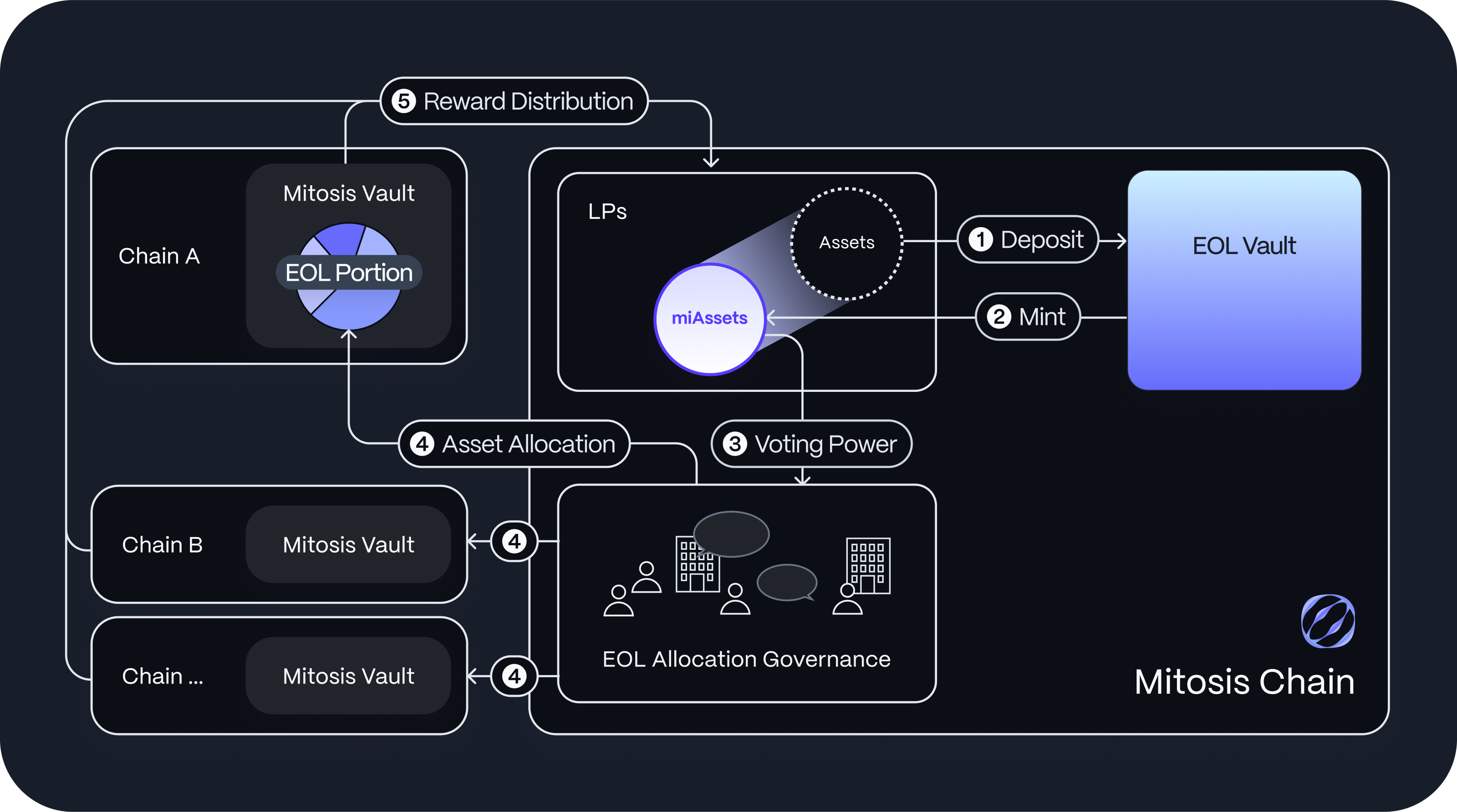

The Mitosis Ecosystem-Owned Liquidity (EOL) concept emerged from the effort to enhance the liquidity provider (LP) experience. EOL enables LPs to access reward opportunities across multiple blockchain networks in an efficient and convenient way. With this in mind, how do LPs interact with Mitosis?

How LPs interact with Mitosis and engage in EOL

How to Onboard Mitosis

LPs begin by depositing their assets into the Mitosis Vault on the network of their choice. Currently, Mitosis Vaults are on Ethereum, Arbitrum, Blast, Linea, Mode, Scroll, Manta, and Optimism. As of today, the vaults accept weETH of and weETHs and plan to expand to various assets, such as other LRTs and stablecoins.

Introducing Mitosis L1 Chain

When LPs deposit their assets into the Mitosis Vault, they receive corresponding assets on the Mitosis L1 Chain. Here, the Mitosis Vault operates as a gateway or bridge to the Mitosis Chain. LPs can then utilize their assets in various applications on the Mitosis Chain. Up to this point, Mitosis is similar to other chains. What distinguishes Mitosis is its Ecosystem-Owned Liquidity Vault (EOL Vault).

Ecosystem-Owned Liquidity

One of the options for LPs on the Mitosis Chain is to deposit their assets into the EOL Vault. Opting in to EOL implies the following:

- LPs agree that the Ecosystem can allocate their underlying assets to various yield sources based on the governance decisions.

- LPs gain the voting power to participate in the ecosystem’s governance decisions on how to allocate EOL.

- LPs receive distributions of yield generated from the allocation of their underlying assets.

These three points are crucial for understanding EOL. Let’s examine each item in more detail.

*The term “underlying assets” refers to the assets in the Mitosis Vault on each chain that LPs deposit to onboard the Mitosis Chain.

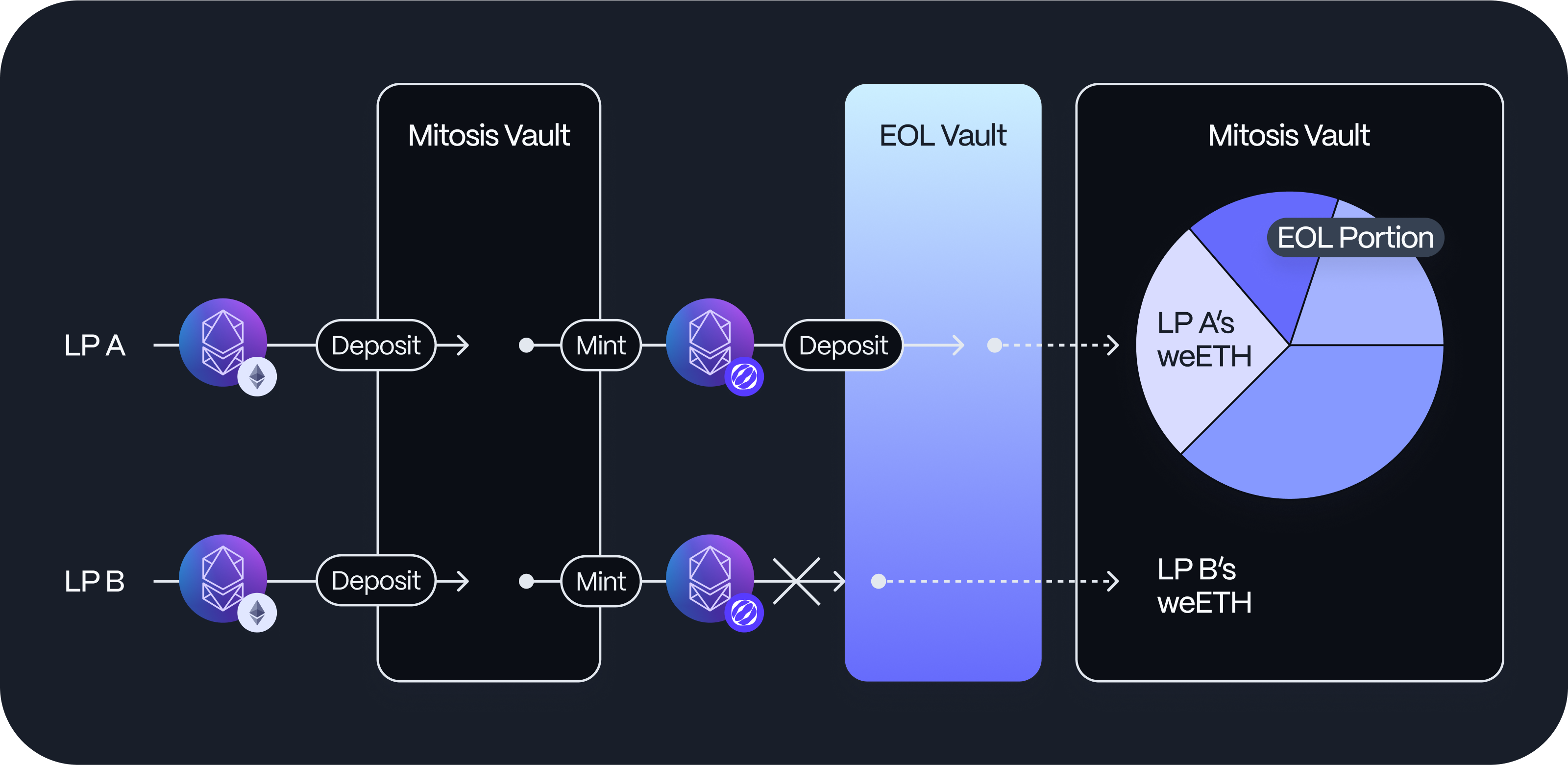

EOL portion in the Mitosis Vault

What if you choose not to opt into EOL? Then, your assets are not subject to EOL allocation. The Mitosis Vaults contain both the EOL portion and non-EOL portion of assets. Here’s how it works:

- Each network’s Mitosis Vault holds assets that LPs deposit to access the Mitosis Ecosystem.

- On the Mitosis Chain, LPs can opt into the EOL Vault.

- Out of the assets in the Mitosis Vaults, only the amount represented by those in the EOL Vault is counted as the EOL portion.

After LP A and B receive weETH on the Mitosis Chain from depositing to the Mitosis Vault on Ethereum, LP A decides to deposit assets into the EOL Vault, while LP B provides assets to a lending protocol on the Mitosis Chain. The amount of underlying assets deposited to the EOL Vault by LP A is counted as the EOL portion, whereas the assets not opted into the EOL Vault stay as the non-EOL portion.

*For the EOL Beta, the Mitosis Chain will not have launched yet; therefore, all assets in the Mitosis Vaults automatically count as the EOL portion. In other words, the Mitosis Ecosystem governance will manage all assets deposited in the Mitosis Vaults.

EOL Allocation

“LPs agree that the Ecosystem can allocate their underlying assets to various yield sources based on the governance decisions.”

Each network’s EOL portion is collectively allocated according to decisions made by the Mitosis Ecosystem. The ecosystem governance determines the protocols for deposits and their allocation percentages. For example, EOL weETH on Ethereum might be split based on the governance results, with 30% in a lending protocol and 70% in a restaking protocol. These deposits then generate yield for Mitosis LPs.

EOL Allocation Governance

“LPs gain the voting power to participate in the ecosystem’s governance decisions on how to allocate EOL.”

Mitosis LPs who opt into EOL can vote to determine the allocation of EOL to various protocols, with voting power proportional to their deposits in the EOL Vault. Ecosystem participants without deposits in the EOL Vault can still join the discussion on EOL allocation, though they don’t have any voting power. These participants include DeFi protocols, LPs, asset protocols, and network builders. Because the entire ecosystem contributes to healthy, capital-efficient EOL allocation, we consider this liquidity “ecosystem-owned.”

Governance Process

The governance process consists of three main stages: Forum Discussion, Initiation Vote, and Gauge Vote. For detailed information on EOL Governance, click here.

- Forum Discussion: The governance process starts when a candidate protocol interested in receiving EOL submits a proposal to the Mitosis Forum. Based on the proposal, all ecosystem participants can join the discussion regarding the candidate protocols’ security profiles, prospects, and reputation, and the appropriateness of their reward proposals.

- Initiation Vote: EOL LPs vote to decide whether to include the candidate protocol in the EOL allocation portfolio.

- Gauge Vote: EOL LPs vote to determine the proportion of liquidity to allocate to each protocol within the portfolio.

Once the governance decides how to manage EOL, the Mitosis Vaults execute the allocation of the EOL portion of assets.

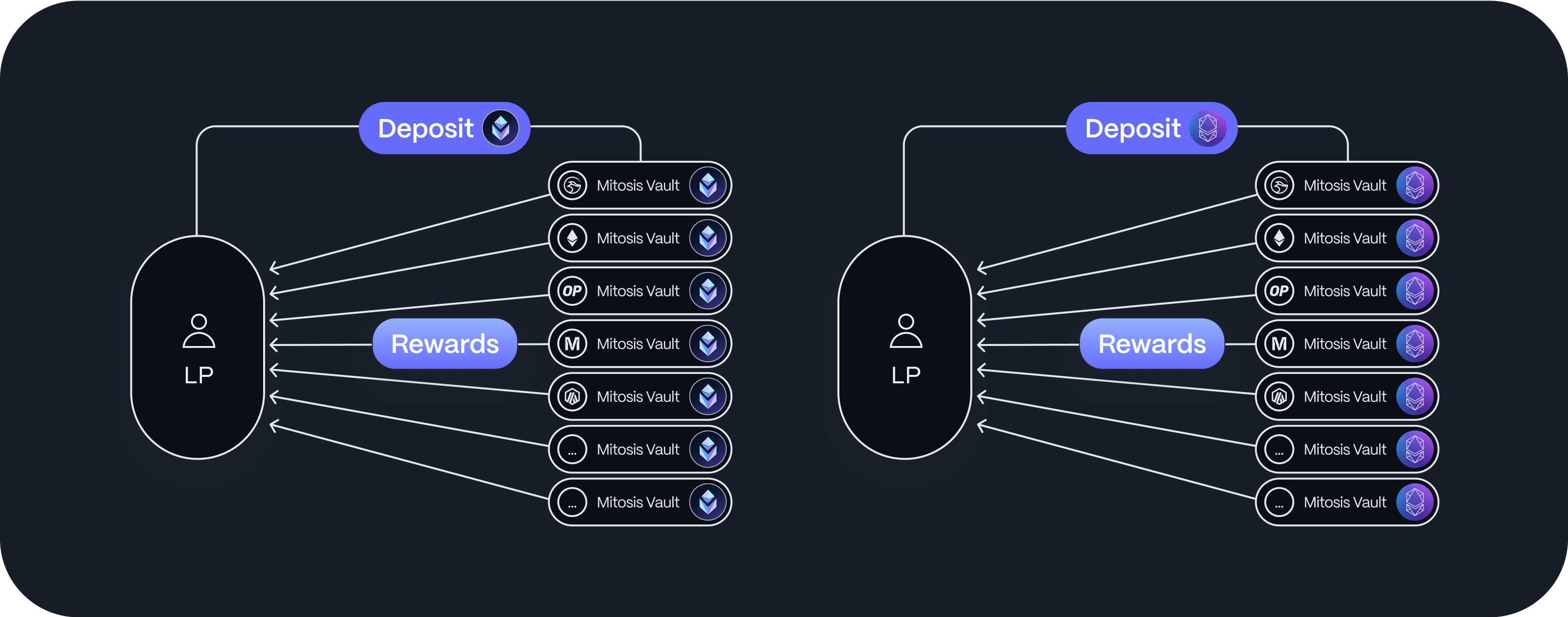

Omni-Sourced Yield

“LPs receive distributions of yield generated from the allocation of their underlying assets.”

LPs who deposited weETH into the EOL Vault receive rewards from all networks, regardless of the network through which they entered Mitosis. However, uniETH providers do not benefit from the yield accumulated on EOL weETH, as it is a different type of asset.

Distributed EOL generates yield, and the reward accumulates separately for each asset regardless of the network. For example, let’s say the Mitosis Vault on Ethereum provides EOL weETH to Ion Protocol, the vault on Arbitrum to Karak, and the vault on Optimism to Prime Protocol. LPs who deposited weETH into the EOL Vault receive rewards from all three protocols, regardless of the network through which they entered Mitosis. This network-agnostic yield accumulation is why it is considered “omni-sourced.” However, uniETH providers do not benefit from the yield accumulated on EOL weETH, as it is a different type of asset.

miAsset

EOL LPs receive miAssets in return for their deposit into the EOL Vault. miAssets are what makes EOL Allocation Governance and yield distribution possible. miAssets serve three main functions:

- Voting Power for EOL Allocation Governance: Voting power is proportional to the amount of miAssets held.

- The Basis for Omni-Sourced Yield Distribution: Omni-sourced yield accumulates on the miAssets.

- Liquid Representative for DApp Utilization: EOL LPs can use miAssets to participate in various DeFi activities on Mitosis.

miAssets, with their default omni-sourced yield, hold significant importance within the Mitosis Ecosystem. An upcoming article will focus solely on how miAssets fuel the flywheel of Mitosis.

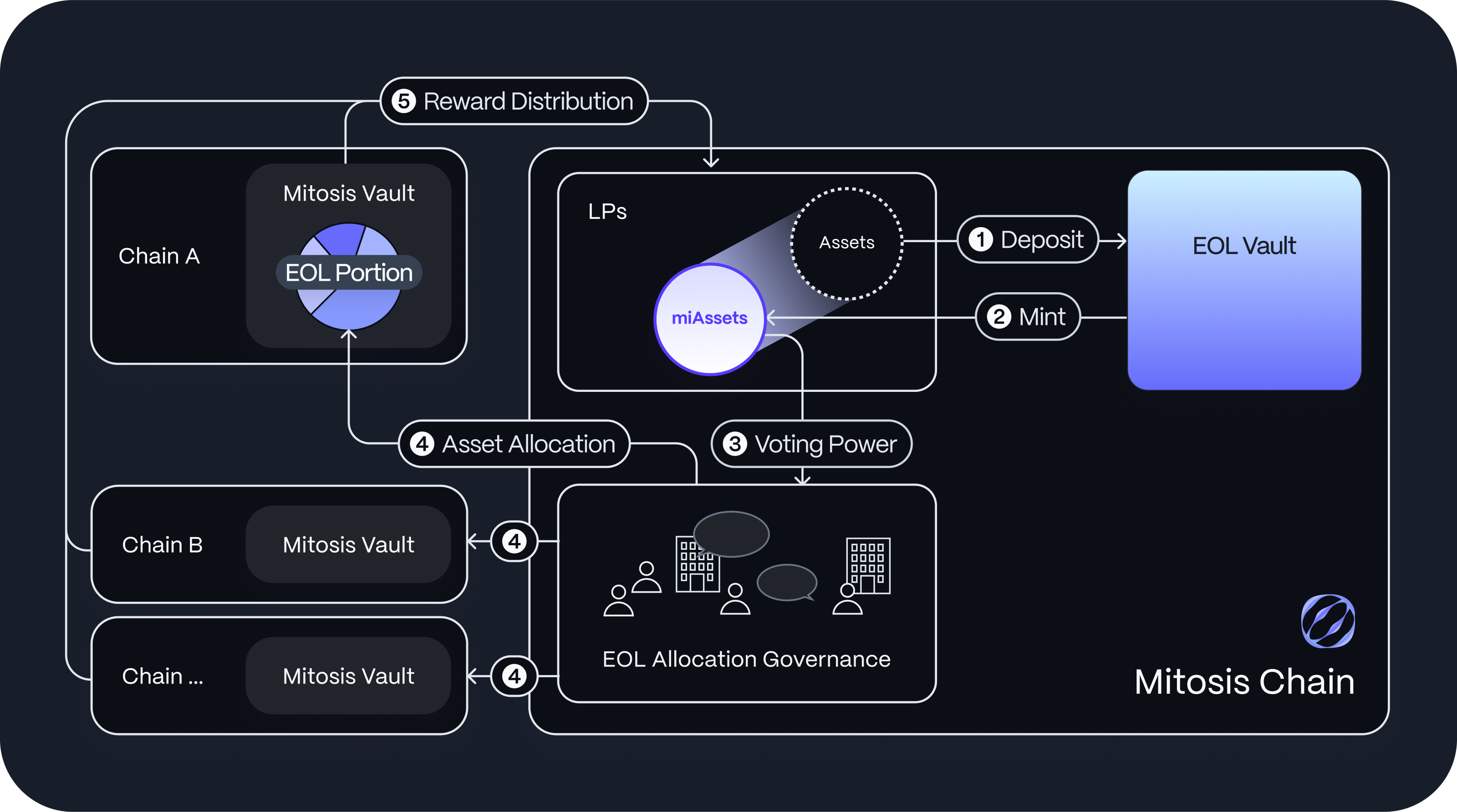

Summary

This article outlines how for LPs can engage with Mitosis and participate in EOL.

After onboarding to the Mitosis Chain, 1. LPs can choose to deposit to the EOL Vault 2. and receive miAssets in return. 3. miAssets represent LPs’ voting power to participate in Asset Allocation Governance, 4. which decides the asset allocation of the EOL portion in the Mitosis Vault. 5. LPs receive rewards generated from multiple chains.

By joining the collective providers of EOL, LPs can enjoy several benefits:

- Curated reward opportunities proposed by the candidate protocols.

- The collective intelligence of EOL LPs and other ecosystem participants.

- A convenient, efficient way to harvest multi-chain yield without moving assets between networks.

These are the individual-level benefits of EOL. In the following article, I will explain how EOL’s structure contributes to the bigger picture — how it creates a level playing field among LPs and enhances market efficiency by reducing opportunity costs.

Read More

View All

Blog

July 16, 2024

Gia

Blog

July 09, 2024

Gia