Announcing the Inaugural Matrix Vault - Theo Straddle

February 25, 2025

|

Blog

We’re announcing the launch of Theo’s Straddle Matrix Vault, their delta-neutral product. It's worth exploring why this infrastructure aligns perfectly with Theo's vision for scaling DeFi. The recent Mitosis Litepaper reveals several key aspects that made this decision compelling.

How It Works

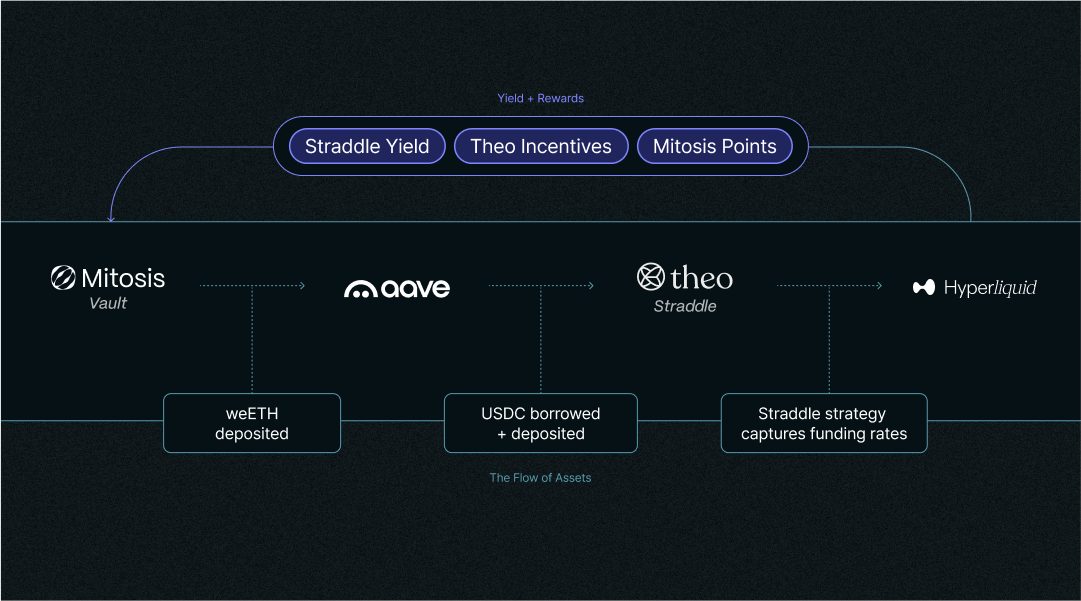

Users deposit weETH to the vault contracts on Ethereum mainnet, Arbitrum, or Linea. At the turn of a new vault round, deposits deploy into Straddle. Deployment entails depositing weETH to the chain’s local Aave instance and borrowing USDC, which is bridged to Hyperliquid and used to put on the short leg of the trade, thus capturing the ETH funding rate. Collateral rebalances automatically as the ETH price fluctuates.

The strategy is entirely delta-neutral with conservative risk parameters. Users can initiate a withdrawal at any time, with withdrawals processed approximately every two days when the vault round rolls.

Select users will be able to deposit weETH and miweETH (for Mitosis Expedition Users) into the vault through the Mitosis Matrix front end once it goes live. Attractive rewards and terms will be clearly stated to all. Depositors will be eligible for Straddle yield, Theo tokens, and Mitosis points. The campaign will end around April May 2025—a detailed schedule will be announced later.

Democratizing Yields

Traditionally, the most lucrative opportunities in DeFi have been gatekept through private deals and hidden point allocations to whale wallets. Theo building on Mitosis ensures their incentives and strategy is accessible to all users, not just those with massive capital, bringing about more efficiency. The focus on efficiency aligns with their mission to scale DeFi beyond its current limitations.

The Matrix Vaults enable Straddle to deploy capital efficiently on Hyperliquid from Ethereum and L2s such as Arbitrum. It also allows Theo to maintain predictable liquidity for their weETH-based strategy and offers enhanced yields through clear maturity structures.

Composability and Capital Efficiency

One of the most compelling aspects of Matrix infrastructure in the case of Theo is how it transforms locked liquidity into programmable positions. For Theo’s users, this means:

- User weETH deposits receive tokenized representations (maAssets)

- These tokens remain usable as collateral or in other DeFi strategies

- Capital efficiency is maximized even while capturing funding rates

Moving Beyond Lockups

Most DeFi protocols face a fundamental dilemma: encouraging long-term liquidity without forcing users into lockup periods. Traditional approaches typically either:

- Require strict lockup periods, alienating users who value flexibility

- Offer no lockups but suffer from liquidity instability

- Use complex token emissions that often lead to mercenary capital behavior

The issue with lockups is that they can create negative sentiment if the yield is unsatisfactory. This sentiment is bad for the value of any governance token incentives being streamed to an opportunity as it results in selling pressure before maturity. Upon the lockup conclusion, any locked-up yield is sold off as it has a self-sabotaging effect on the project's longevity.

The Matrix Vault implementation takes a different approach. Users can initiate withdrawal at any time (processed within ~48 hours), but Forfeiting a portion of accmulated yields.

Matrix creates a natural incentive alignment without forcing users into inflexible positions.

Looking Forward

For Theo, this approach offers more predictable liquidity incentivization without strict lockups, mercenary capital filtering, reduced vault management complexity, and incentives alignment between protocol and users. Rolling out Straddle demonstrates how sophisticated financial strategies can be democratized through the proper infrastructure.

For our users, this means access to institutional-grade strategies and the flexibility to utilize their position tokens within the broader DeFi ecosystem. Regarding integrations, this means building on infrastructure that can support our ambitious vision for the future of decentralized finance.

This model could set a new standard for DeFi liquidity management. Combining Matrix's infrastructure with natural incentive mechanisms creates a more sustainable and user-friendly approach to protocol liquidity.

The withdrawal flexibility with yield-based incentives represents a mature evolution in DeFi protocol design that respects user autonomy and protocol sustainability. As Theo continues to develop, this foundation will enable their team to build even more sophisticated financial products that serve users' needs while maintaining protocol stability.

About Theo

Theo is a stablecoin network built to scale DeFi. It coordinates a balance sheet of stablecoins and other assets across execution environments, enabling various capital-efficient financial applications—from delta-neutral vaults to complex leveraging or hedging strategies—with instant settlement, global cross margin, and more.

About Mitosis

Mitosis is a network that transforms DeFi liquidity into programmable primitives by enabling users to deposit assets into Vaults and receive tokenized positions that can be used across DeFi applications on the Mitosis Chain. Through its liquidity frameworks, starting with Matrix, Mitosis democratizes access to preferential yields while creating transparent price discovery mechanisms for liquidity. The protocol aims to establish a mature DeFi ecosystem by enabling sophisticated financial engineering through programmable liquidity, addressing key inefficiencies like capital inefficiency and unstable TVL.

Website / X / Discord / Telegram / Expedition / Documentation

Read More

View All

Blog

February 28, 2025

Tex

Blog

February 25, 2025

Zach