Mitosis' Integration of Babylon Liquid Staking BTC

August 29, 2024

|

Blog

The Mitosis team has reached a consensus to support Bitcoin liquid staking tokens (BTC LST). Let's explore how Mitosis can enhance BTC LST’s wide adoption to economically scale network security in the multi-chain era.

Mitosis has always been dedicated to facilitating a healthier transition to the multi-chain landscape. This shift is challenging as more chains lead to greater resource fragmentation. Among key blockchain infrastructure resources, liquid staking BTC plays a role in mitigating fragmented security.

Proof of Stake (PoS) is one of the most popular consensus mechanisms today. Roughly speaking, for a PoS chain to be economically secure, the value of staked assets must exceed that of assets at risk on the chain. However, as more chains emerge, staked assets are spread thinner across them, weakening the security of each.

Cross-chain staking projects such as restaking and mesh security have emerged to address fragmented security. These concepts allow staked assets to be used as collateral by multiple entities simultaneously. They also provide a marketplace for new chains to outsource security when their initial staked assets are insufficient.

BTC has recently entered the cross-chain staking landscape. With a $1.1 trillion market cap, BTC’s collective value is 3.66 times larger than that of ETH, the leading staked asset. Since 70% of BTC has been inactive for over a year, channeling this idle BTC into staking could significantly boost the security pool while providing holders with a relatively safe yield.

Babylon is the leading project in BTC cross-chain staking. It allows staked BTC to remain on the Bitcoin chain while securing consumer PoS chains. By adding Babylon’s finality gadget layer on top of their consensus layer, any PoS chain can leverage staked BTC. Babylon also plans to expand into restaking, positioning its chain as both a control panel and marketplace for security.

Several teams are building liquid staking Bitcoin protocols on top of Babylon, similar to Lido on Ethereum’s consensus layer. These protocols issue derivatives that represent LPs’ staked assets, enabling LPs to earn staking yields while keeping their assets liquid for DeFi use. Projects like Lombard and Solv are developing BTC equivalents to stETH.

The widespread adoption of LSTs drives an increase in staked assets, as higher demand for LSTs leads to more staking to mint them. The Mitosis team aims to boost the amount of staked BTC in Babylon by accelerating BTC LST adoption across smart contract blockchains. Mitosis’ integration of BTC LSTs into its omni-chain liquidity marketplace will bring the following benefits to BTC LSTs:

Modular Expansion

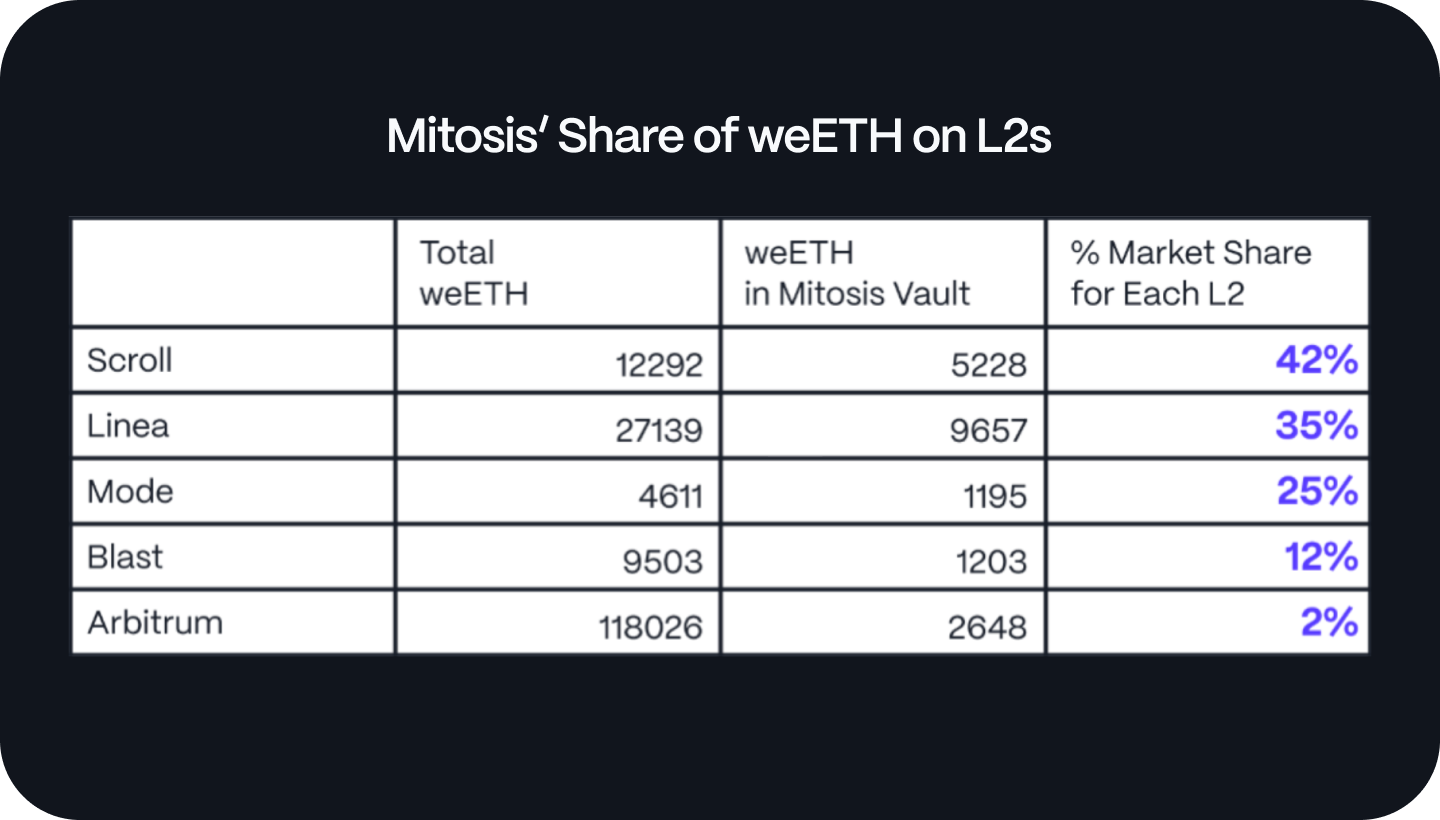

Mitosis' liquidity marketplace is currently embedded in eight networks. When Mitosis bootstraps assets in its vaults on each network, LPs willingly move their assets across networks to gain exposure to Mitosis’ benefits. Mitosis' role in asset spread was proven when it supported weETH on multiple L2s.

Utility

Once Mitosis successfully launches an asset in its liquidity marketplace, it maintains significant holdings across each supported chain. This readily deployable bulk liquidity attracts dApp builders to create use cases, as they find it more efficient to build on existing liquidity rather than encouraging individual LPs to move their assets across networks.

Activity

Liquidity in Mitosis Vaults is dynamically allocated to dApps within each network. Passive LPs can simply deposit their assets into Mitosis Vaults, while more active LPs can directly influence the strategy to ensure that liquidity distribution aligns with market sentiment. As a result, previously idle or static liquidity of passive LPs begins to flow, leading to increased trading activities and innovations around the asset.

Exchangeability

Mitosis L1 is a hub where representatives of assets supplied to liquidity marketplaces across various networks converge. With diverse assets from different networks, Mitosis functions as a value exchange layer, where users can exchange or cross-chain transfer their assets. This enhances the exchangeability of integrated assets.

The above advantages that Mitosis provides will help BTC LSTs penetrate deeply into smart contract-based networks. Their widespread adoption will lay the foundation for deep and stable liquidity in the BTC security pool.

The shared mission of resolving resource fragmentation in the multi-chain era has driven Mitosis to initially support LRT and BTC LST. Mitosis is an attempt to solve the liquidity fragmentation problem in the multi-chain era. Fragmented liquidity across numerous chains hinders innovations that rely on liquidity. Mitosis embeds an on-chain liquidity marketplace in each network to optimize liquidity distribution. More articles will follow to explain how the Mitosis Ecosystem maximizes liquidity distribution efficiency by directly reflecting market sentiment in its on-chain marketplaces.

Read More

View All

Blog

September 09, 2024

Tex

Blog

August 29, 2024

Gia