The Struggle of Retail LPs

July 16, 2024

|

Blog

Multi-Chain Era

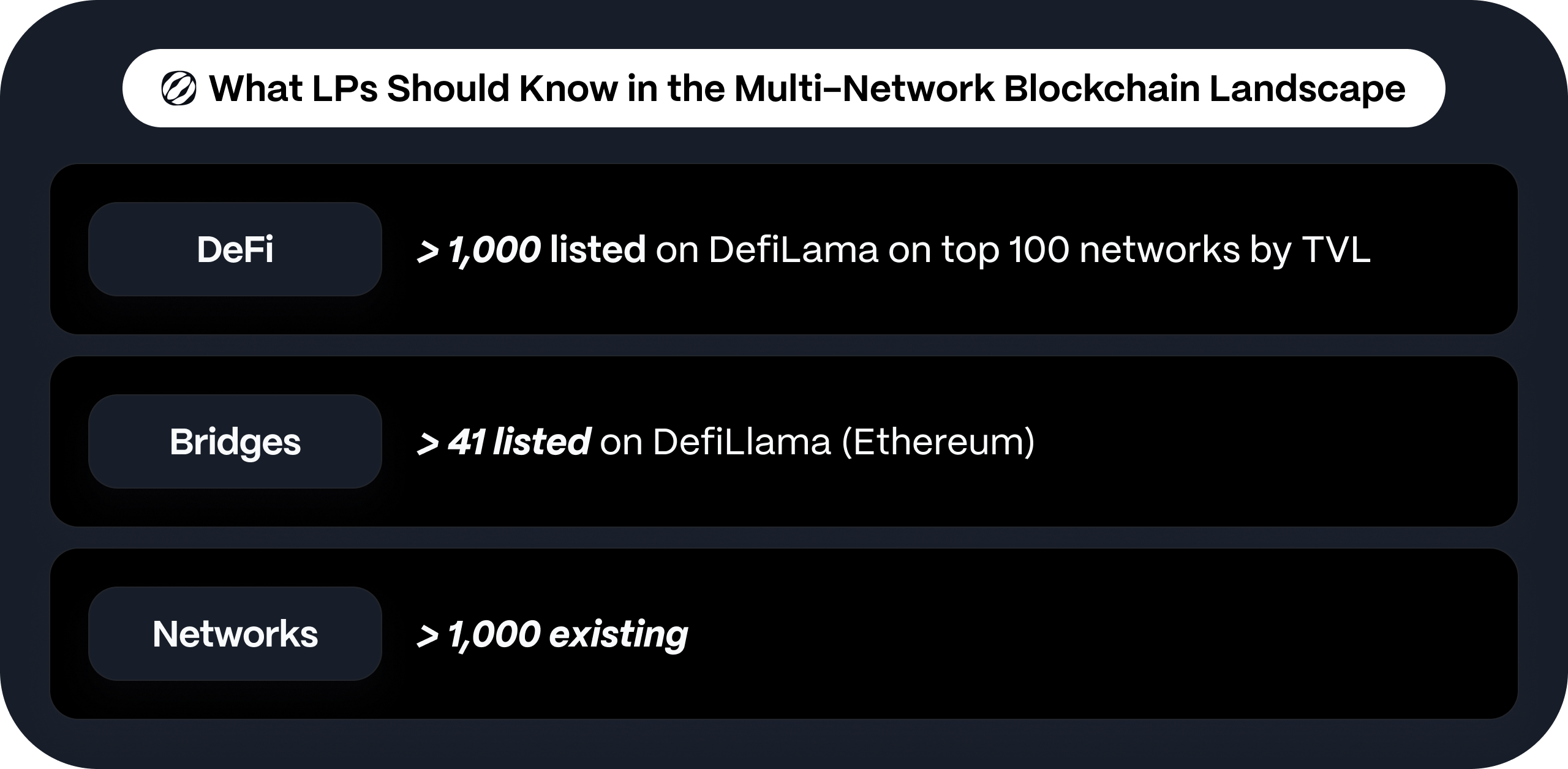

The blockchain landscape is entering a multi-chain era with the advancement of modular architecture. The modular transition has significantly reduced the time and effort required to create new blockchain networks. This change has resulted in a surge of new networks and a rapid increase in DeFi applications on top.

Protocols in Need of Liquidity

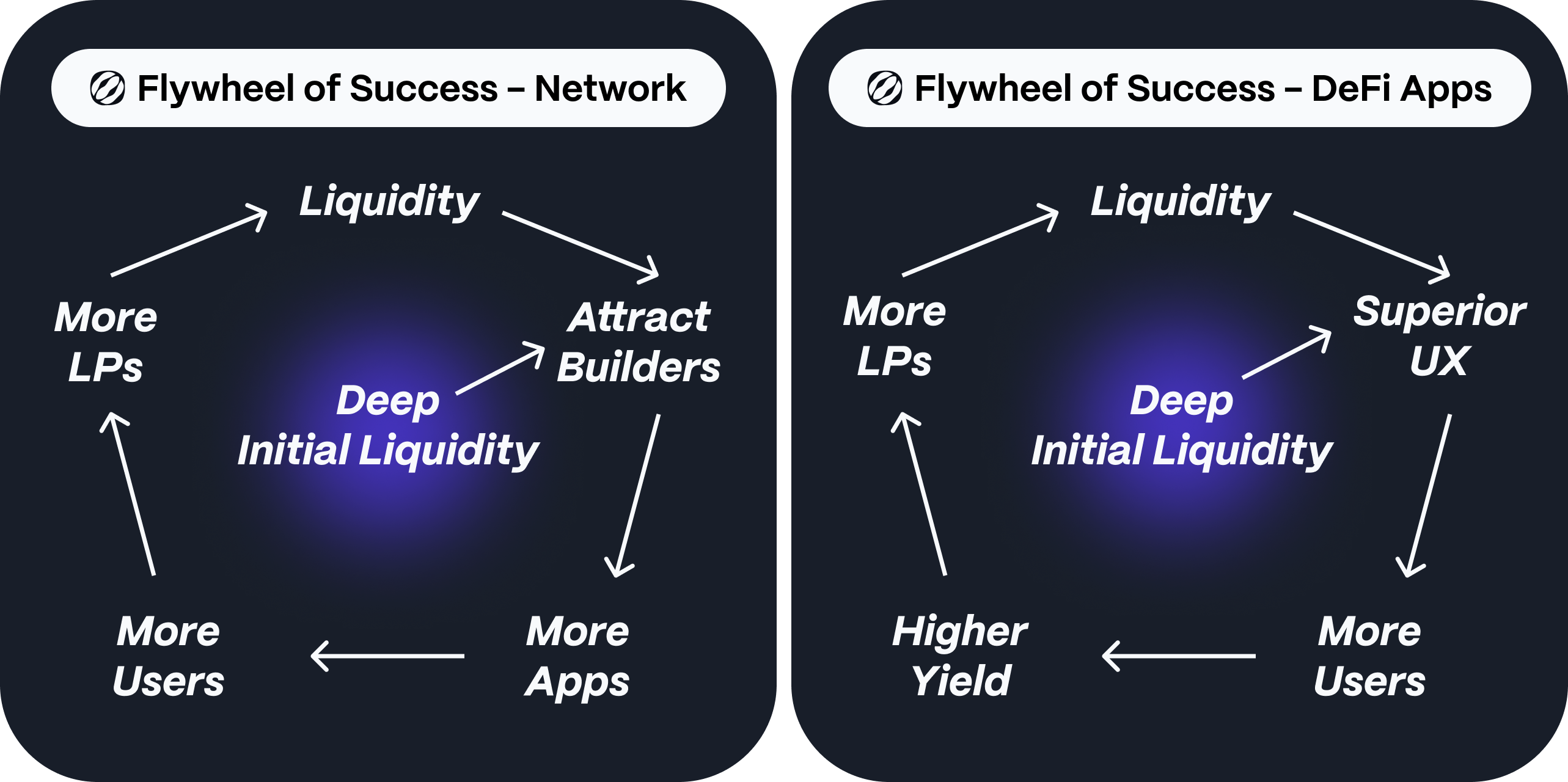

These protocols, a term here encompassing both networks and applications, often require deep liquidity to succeed. Networks need liquidity to attract builders so they can create use cases and foster a thriving ecosystem. For most applications, depth of liquidity directly impacts user experience.

Initial liquidity

However, bootstrapping sufficient liquidity from the outset is nearly impossible for protocols due to the interdependence between liquidity and usability. Attracting organic liquidity requires substantial use cases to generate attractive yields, but creating these use cases necessitates liquidity. To break this cycle, many protocols allocate significant rewards, often in the form of their native tokens, to secure initial liquidity until their service can naturally draw in organic liquidity.

Deep initial liquidity triggers a positive flywheel, where more use cases attract even more liquidity. Conversely, insufficient liquidity leads to a downward spiral.

An Opportunity for LPs, But an Unlevel One

In this context, the multi-chain transition presents an opportunity for LPs. Those who can identify promising projects amid the surge of new or network-expanding protocols can achieve significant alpha by allocating their liquidity accordingly. However, not all LPs have equal access to these opportunities.

Disparity Among LPs with Different Liquidity Scales

The disparity among LPs arises from variations in the scale of liquidity they hold. In the current dynamic, retail LPs often find themselves at a disadvantage compared to large-scale LPs. This imbalance does not stem from any specific market participant or malicious intent. Rather, it is a structural issue rooted in the blockchain architecture and market dynamics.

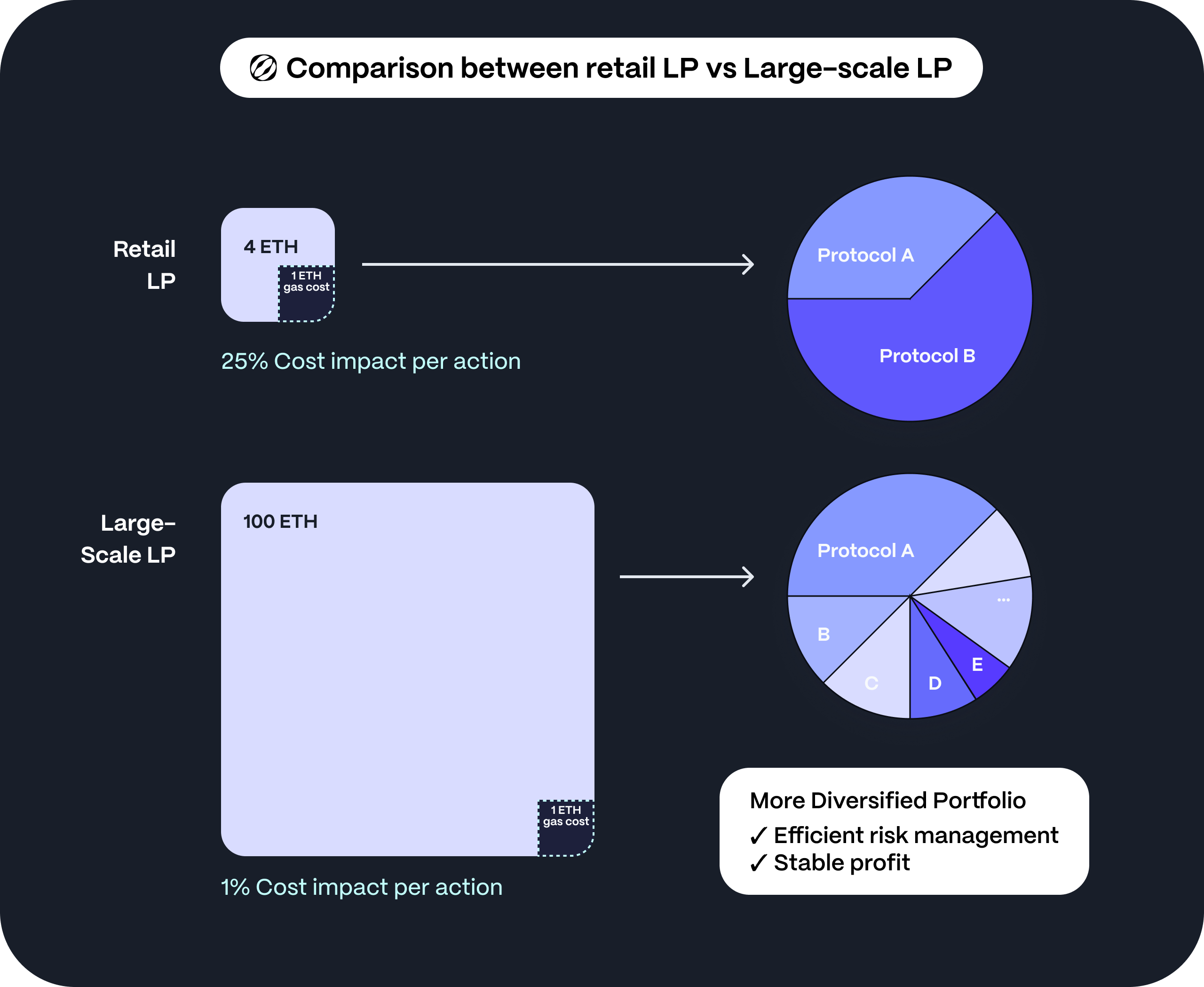

Cause of Disparity: Varied Impact of Fees

The most straightforward example of how varying liquidity scales create an uneven playing field is the difference in the impact of costs. Gas costs, protocol fees, and bridging costs disproportionately affect LPs with smaller liquidity. Consequently, retail LPs face greater challenges in diversifying their portfolios, which hampers their ability to achieve stable profits and manage risks. These costs also prevent them from capturing better opportunities when they arise.

Gas costs, protocol fees, and bridging costs disproportionately affect LPs with smaller liquidity, hindering their ability to diversify portfolios for stable profits and spread risks.

Cause of Disparity: Varied Accessibility for Private Negotiations

A more subtle factor driving the disparity among LPs is the growing prevalence of private negotiations between large-scale LPs and protocols. This trend emerges because the current market dynamics prevent protocols from relying on retail LPs to establish initial liquidity. But what specifically makes the protocols turn away from retail LPs?

Challenges in Liquidity Bootstrapping from Retail LPs

For protocols to attract and maintain users for their services, stability and scale in their initial liquidity are crucial. Bootstrapping liquidity publicly from retail LPs is not the most optimal strategy for achieving these two goals.

- With smaller-scale liquidity, a larger number of LPs is required, leading protocols to incur significant marketing costs to reach them.

- Despite substantial marketing efforts, uncontrollable factors such as competitive protocols and market conditions may impede the recruitment of enough LPs.

- The uncertainty in bootstrapping outcomes leads to inefficient spending. If protocols fail to gather sufficient liquidity, they end up spending a large amount on rewards for relatively small liquidity.

- LPs often cherry-pick rewards and move on to other yield opportunities, challenging stable liquidity maintenance.

- Addressing the diverse needs of various LPs is challenging and often results in dissatisfaction once the rewards are finalized.

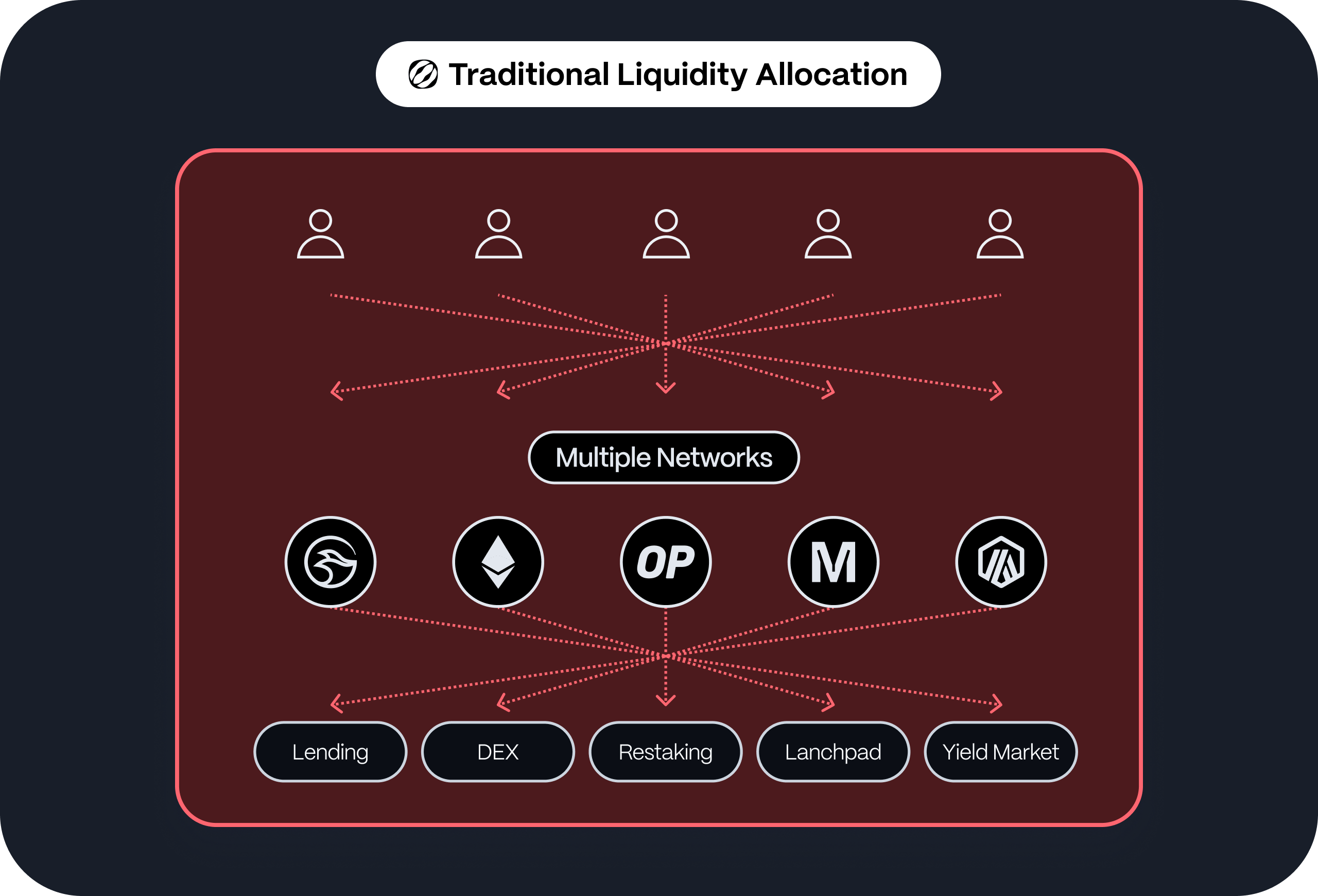

Multi-Chain Transition Aggravates The Challenge

The multi-chain transition exacerbates the challenge for protocols to collect initial liquidity from retail LPs.

- User base fragments across numerous networks. Attracting liquidity from these networks requires persuading each retail LP to overcome hurdles to move their funds.

- As the blockchain landscape becomes more complex with emerging networks, uncontrollable factors become even harder to predict.

- The surge of new protocols leads to a flood of reward opportunities. Retail LPs are willing to move their liquidity for more lucrative rewards, intensifying the liquidity’s volatility.

The multi-chain transition exacerbates the challenges for protocols to bootstrap liquidity from retail LPs due to user base fragmentation, increased unpredictability, and an overload of choices.

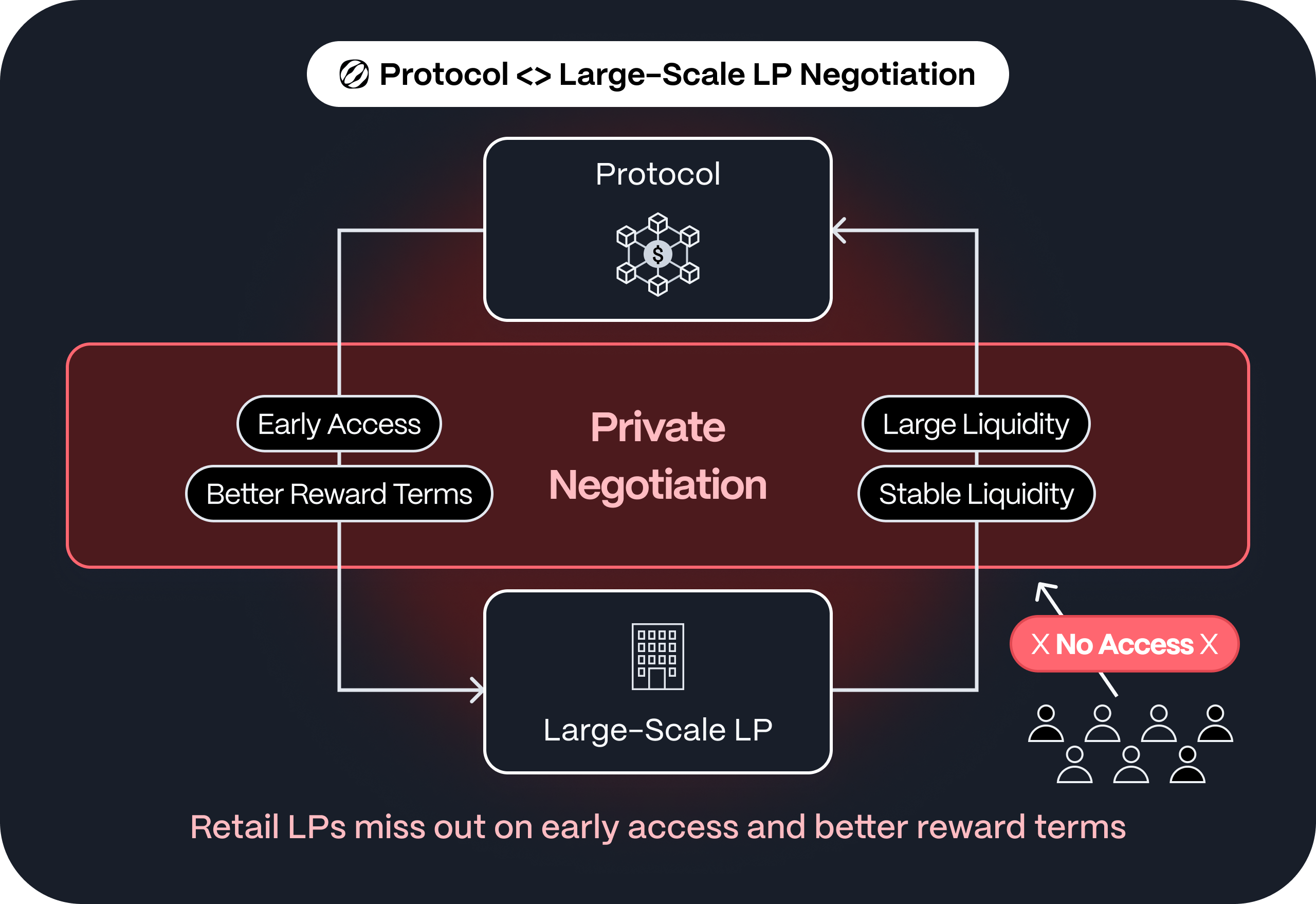

Growing Prevalence on Private Negotiations with Large-Scale LPs

Due to these dynamics, many protocols turn to contract-based private deals with large-scale LPs to ensure the stability and scale of initial liquidity. These private deals are essential, as they enable protocol builders to experiment with their ideas and enrich the blockchain ecosystem. However, private negotiations impose disadvantages on retail LPs, such as limited access and undisclosed pricing.

Challenges on Retail LPs - Limited Access

The prevalence of private negotiations with large-scale LPs limits retail LPs' access to yield opportunities. Large-scale LPs leverage their stability and scale of liquidity to negotiate superior yields from protocols. However, retail LPs, lacking such bargaining power, miss out on better reward terms and early access opportunities.

Retail LPs do not have access to private negotiations between large-scale LPs and protocols.

Challenges on Retail LPs - Lack of Transparent Pricing

Another issue is the lack of public disclosure of terms. As these private deals increase, price discovery for liquidity becomes impossible, and there is no standard for determining the appropriate yield for liquidity provision. This lack of clear benchmarks makes it difficult for retail LPs to make informed decisions. Consequently, retail LPs are at risk of bearing more risk for fewer rewards.

Challenges on Retail LPs - Overload of Choices

The dynamics between large-scale LPs and protocols typically involve protocols seeking out LPs, while retail LPs must research and find opportunities themselves. In a multi-chain landscape where reward opportunities are diverse and complex, this structure creates significant disparity. Additionally, the higher cost impact on retail LPs hinders their ability to diversify their portfolios, making it difficult to maintain stable profits and manage risks effectively. Amid the overload of choices, retail LPs often get lost.

The complexity of the multi-chain landscape makes informed decision-making challenging.

Retail LPs in Multi-Chain Era

The multi-chain transition unintentionally exacerbates the unlevel playing field based on the liquidity scale that LPs hold. Retail LPs face challenges such as limited access to private reward terms, a lack of benchmarks to determine appropriate yields, and the burden of navigating a complex array of choices. While yield aggregators and yield curation services attempt to address these issues, they only alleviate part of the difficulties mentioned.

This is Why We Came Up with EOL

This is where we began, developing the concept of Ecosystem-Owned Liquidity. However, EOL is designed to benefit all types of market participants, including protocols, retail LPs, and large-scale LPs. By providing equitable access, clear price discovery, and streamlined processes, EOL aims to ensure that both LPs and protocols thrive in the evolving environment. In the next article, I will dive deeper into EOL and its attempts to facilitate a healthier transition to a multi-network blockchain landscape.

Read More

View All

Blog

July 24, 2024

Gia

Blog

July 16, 2024

Gia