Why Even Have Token Incentives in Decentralized Finance?

December 23, 2024

|

Blog

Whatever happened to profitable DeFi LPing? Why don't users deposit or provide liquidity in return for "real yield" or "the tech" anymore? Let's explore why additional incentives have become required for the TVL growth of chains and DeFi protocols.

Consider the early days of Uniswap. When it first launched, the platform faced a fundamental question: How could it convince users to provide liquidity in a novel and untested financial environment? The answer lay not in traditional financial incentives but in an on-chain incentives-based approach that altered economic participation. Without incentives, there wouldn't have been the alignment to get Uniswap past vampire attacks, charging front-end fees and prolonged UNI fee switch discussions.

To truly understand the emergence of token incentives, we must first trace decentralized finance's technological and economic metamorphosis. The journey begins not with DeFi but with the fundamental reimagining of financial coordination enabled by blockchains.

The History of Decentralized Incentives

Bitcoin introduced the first revolutionary concept: a decentralized economic coordination mechanism where participants are incentivized through block rewards and transaction fees. This was more than a technological innovation – it fundamentally reimagined how economic systems could self-organize without central authorities.

Ethereum expanded this concept dramatically. Smart contracts transformed blockchain from a simple financial ledger to a programmable economic infrastructure. Suddenly, incentive mechanisms could be coded directly into the fabric of financial interactions. PoS iterated on this further to improve Ethereum's long-term sustainability. From Day 1, incentives have been a necessary part of chains, which has spilled over to DeFi.

The Token Incentives Expectation Shift

In DeFi as we know it, token incentives have become an expected feature, not a bonus, of protocols due to the focus that all chains have taken toward incentive alignment and heavily rewarding early contributors.

Market Education: Users have become increasingly sophisticated, understanding that early-stage protocols require economic bootstrapping. The right incentive design rewards users and instills in them the belief that the protocol can scale. If adequate incentives are distributed to users, then a user can have confidence that value will stay within the protocol and not be withdrawn by others, ensuring the flywheel continues.

Risk Compensation: Incentives are direct compensation for bearing technological and market uncertainty. This comprises the economic risk behind adopting the overall protocol, which will inform the success and value of incentives.

Opportunity Costs: With many opportunities to earn incentives and strong low-risk sources of yield, incentives have become necessary to make LPing logical at the early stage while the protocol is scaling. Because choosing amongst LPing opportunities is zero-sum, the opportunity cost amongst incentivized protocols relies on factors such as the relative incentives' expected appreciation/depreciation compared to other opportunities.

Ecosystem Alignment: Tokens create a mechanism for users to become active participants in shaping a network from being early, not just passive users.

Tokenomics Defining Adoption

Take the emergence of AMMs like Curve. When liquidity providers chose to LP, they weren't solely seeking short-term returns but participating in creating a more efficient, decentralized financial infrastructure that they could own a part of. Protocols like Convex, Yearn, StakeDAO, and Abracadabra all sought to build on top of Curve.

Curve DAO attracted interest thanks to Curve's incentive design. Deep liquidity is essential for attracting users to an AMM, yet users hesitate to participate without existing liquidity. This paradox necessitates strategic incentive design per the protocol, whether this is a money market, DEX, etc.

We have seen emission schedules, airdrop allocations, distribution charts, lockups, vesting, and fee switches make or break this year's first few months of token launches. This cites how paramount incentives have become in crypto and their compounding importance in scaling a protocol.

The Network Effects Imperative

Network value in DeFi follows a non-linear progression. Each new participant doesn't just add incremental value—they exponentially enhance the platform's utility, liquidity, and economic potential.

The Aave lending protocol exemplifies this dynamic. As more users provided liquidity, the platform's capabilities expanded, creating increasingly sophisticated lending and borrowing mechanisms. Token incentives were the initial catalyst behind growing Aave's TVL, transforming a conceptual platform into a robust financial ecosystem.

In the rapidly evolving DeFi landscape, differentiation becomes an art form. Protocols compete not just on returns but also on innovative mechanisms, community engagement, and technological sophistication, all of which impact the perceived long-term scalability of incentives.

Balancer, for instance, distinguished itself by offering multi-token liquidity pools with customizable weightings. Token incentives here weren't merely about attracting capital but inviting users to participate in a fundamentally different approach to scaling a functional system.

Additionally, a certain amount of liquidity is required for most marketplace-type protocols to become operable. In the bootstrapping phase, the next marginal dollar of TVL creates outsized benefits for the protocol until you reach the operable threshold of TVL for a protocol. With this, the game theory behind the minimum threshold of incentives becomes ever more necessary, determining if incentives and the project will be valued and whether the project can operate sustainably due to the level of incentives provided.

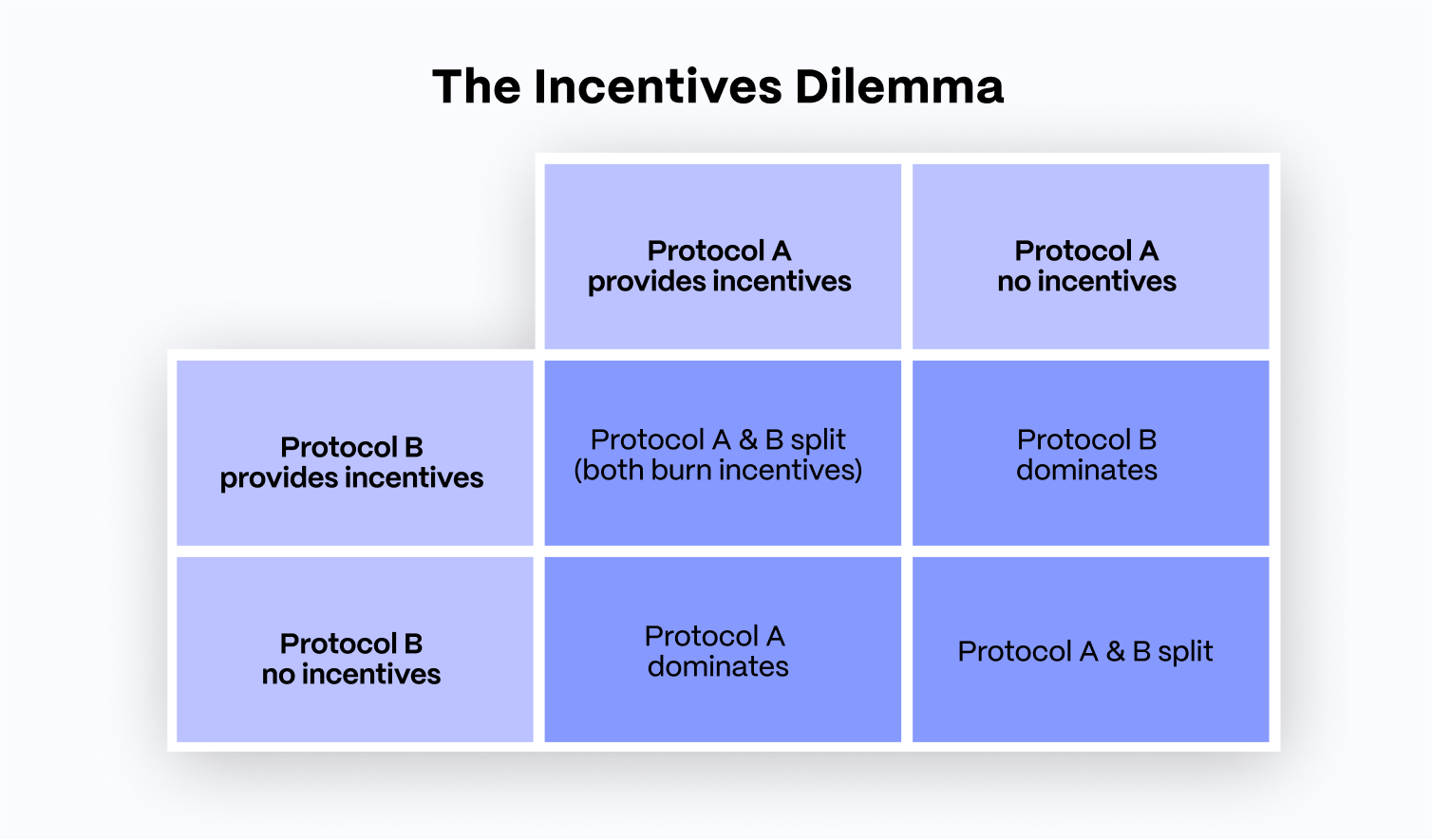

The market's opportunities determine the minimum threshold of incentives required. Following the Prisoner's Dilemma, projects are worse off if they don't offer incentives, as the project will be unequivocally worse and have no network effects or monetization if they can make a compelling incentive offering.

The Incentives Dilemma

Although two prisoners are in the typical scenario, the many protocols and chains amplify this situation. With these many LPing opportunities, there are always token incentives (there is no opportunity for collusion). The differing context adjusts the scenario, making the rational decision to incentivize due to the lack of moat and opportunities to organically keep users sticky, which an early-stage project must deal with.

Token incentives are logical. Even beyond the need for incentives, the ability to offer more substantial incentives during bootstrapping allows for marginally more liquidity until token incentive opportunities across protocols fall into equilibrium due to incentive dilution. A protocol with more significant and deeper incentives can infinitely capture more value. Due to the effects of being a protocol with the leading amount of liquidity, the protocol achieves social proofing, creating second-order benefits around liquidity provision.

The Deeper Microeconomics of Incentivization

Beyond surface-level rewards, token incentives represent a complex game-theoretic mechanism. They align individual economic interests with the scaling of broader technological development, creating a symbiotic relationship between LPs and projects.

DeFi has seen emission schedules, airdrop allocations, distribution charts, lockups, vesting, and fee switches make or break this year's first few months of token launches. This cites how paramount incentives have become in crypto and their compounding importance in scaling a protocol. This short-term period of sentiment discovery is critical in forming and ensuring the future of the perceived value of incentives.

Factors Influencing Incentives Demand

Token types, majors, alts, stablecoins, etc., determine the yield opportunities available. The incentives for yield opportunities vary depending on the token type, as different tokens offer more substantial use cases across protocols.

For example, before GMX v2 was live during GMX v1's reign, GLP yielded a minimum 30D APY of 10%; this applies to all assets within the basket.

For that period on Arbitrum, the high APY of GLP in GMX v1 reduced the TVL of the basket assets in other protocols.

This is an example of the differences between competitive incentive requirements and various tokens. Specific token TVL can be even more critical to a protocol's sustainability. As a result, additional token incentives offered have more or less importance depending on the pool or market. This parity can effectively incentivize certain pools/markets to capture the best highly utilized scalable TVL, creating more outsized returns.

The key reason behind putting outsized returns first is that in high-yield environments, it creates a more optimal scenario for an eventual fee switch, which is best for a sustainable protocol, the end goal of all incentives design.

Conclusion: The Future of Decentralized Token Incentives

Token incentives represent more than a tactical growth strategy. They are a fundamental innovation in how human economic communities can self-organize, coordinate, and create value.

The most successful protocols will view incentives not as a cost when used correctly but as a generative economic mechanism for creating new forms of financial interaction. The current DeFi landscape makes token incentives necessary for new projects to offer a future with more sustainable tokenomics.

Read More

View All

Blog

January 02, 2025

Tex

Blog

December 23, 2024

Zach