Inside Look - Unveiling Mitosis' Strategy

July 24, 2024

|

Blog

What’s Mitosis doing? Why is Mitosis collecting liquidity? What’s happening in the forum? What comes next? Well, here’s an article that reveals Mitosis’ strategies. Let’s sneak into Mitosis team’s thought process.

Mitosis’ Problem Statement: Unlevel Playing Field for Retail LPs

Mitosis began by identifying the struggles retail LPs face:

- Unlike whales, retail LPs lack bargaining power and miss out on private negotiations with better reward terms.

- Reward terms for public yield options are often ambiguous compared to private deals.

- Private terms prevent the establishment of benchmark yields, further increasing the risk of opportunity costs.

- Fees such as gas and bridging costs have a greater impact on retail LPs, hindering portfolio diversification.

Link to "The Struggle of Retail LPs"

Mitosis’ Approach

To address these disadvantages, Mitosis used an approach that simulates protocols approaching large-scale LPs for bulk liquidity and integrated this process on-chain. Mitosis then made two key changes to this scenario:

- Mitosis opened previously private negotiations to allow access to all LPs.

- Mitosis made previously private terms transparent and publicly accessible to everyone.

Here is the step-by-step process Mitosis is executing.

The First Step - Securing Bulk Liquidity

The first step is to gain strong bargaining power by collecting bulk liquidity. To achieve this, Mitosis deployed vaults on each chain and accepted deposits from all types of LPs. Thanks to our supporters, Mitosis has gathered approximately $100 million to date. This liquidity appeals to protocols preparing for new launches, chain expansion, and use case diversification. Several protocols have already lined up to negotiate favorable terms for LPs. By shifting LPs’ access point from individual negotiations to the liquidity pool, Mitosis achieves its first goal: granting all LPs access to bargaining power.

Mitosis has raised $100M to enhnace its LPs' bargaining capacity with protocols.

The Second Step - Displaying Clear Reward Proposals for Comparison

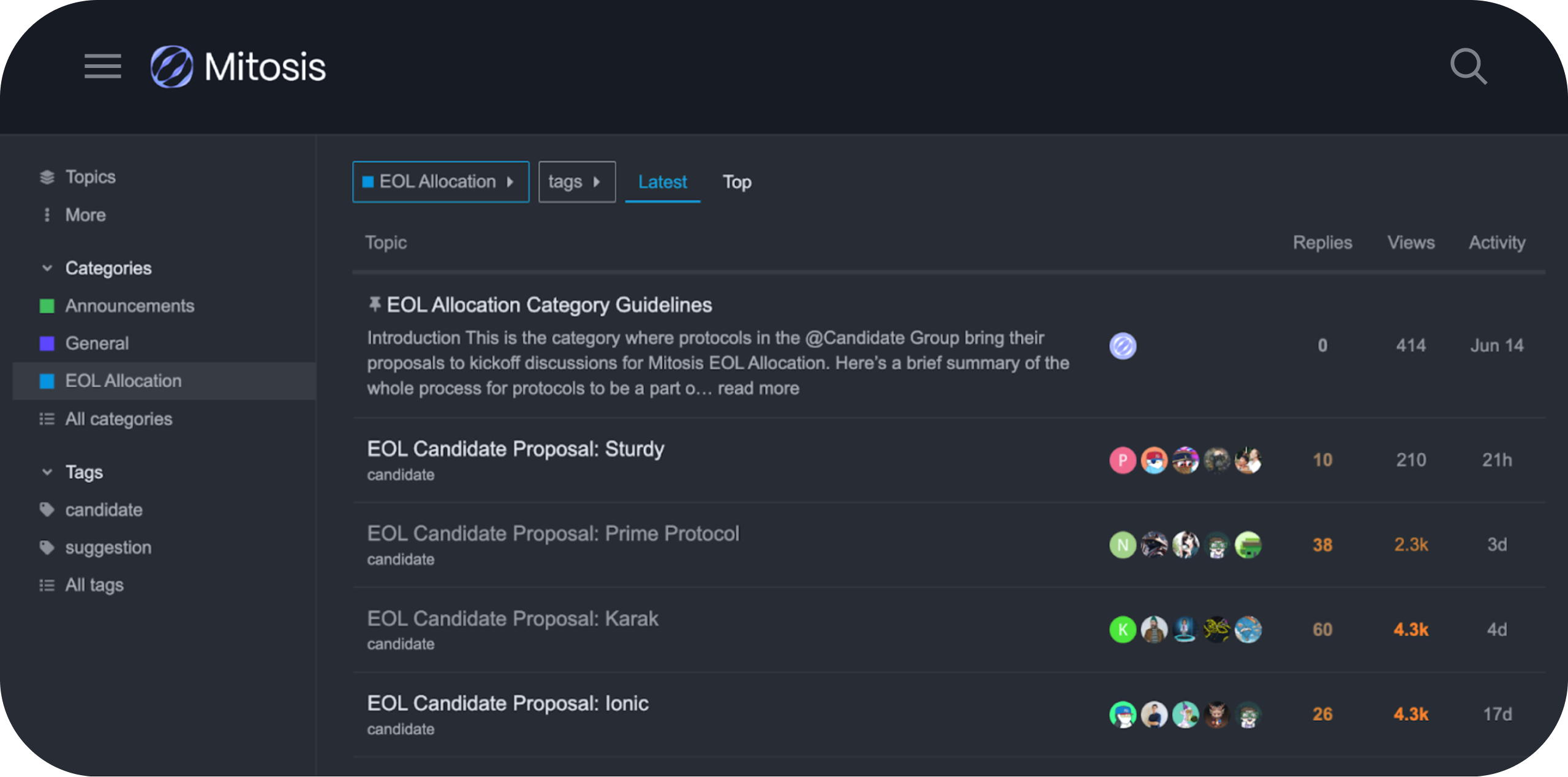

The second step is to have candidate protocols post clear reward terms on an open platform. To facilitate this, Mitosis runs an open forum where protocols interested in pooled liquidity post their introductory and reward proposals. The forum makes previously private reward terms fully transparent. Additionally, Mitosis provides a standardized format to ensure straightforward comparisons between reward terms. This step allows Mitosis to fulfill its second goal: providing clear reward terms upfront.

Candidate protocols post reward proposals on the forum to compete for Mitosis' liquidity. LPs can make informed decisions by comparing clear reward terms.

Currently, introductory proposals from Karak, Prime, Ionic, and Sturdy are available, with reward proposals to follow soon.

The Third Step - Ecosystem-Driven Decision-Making

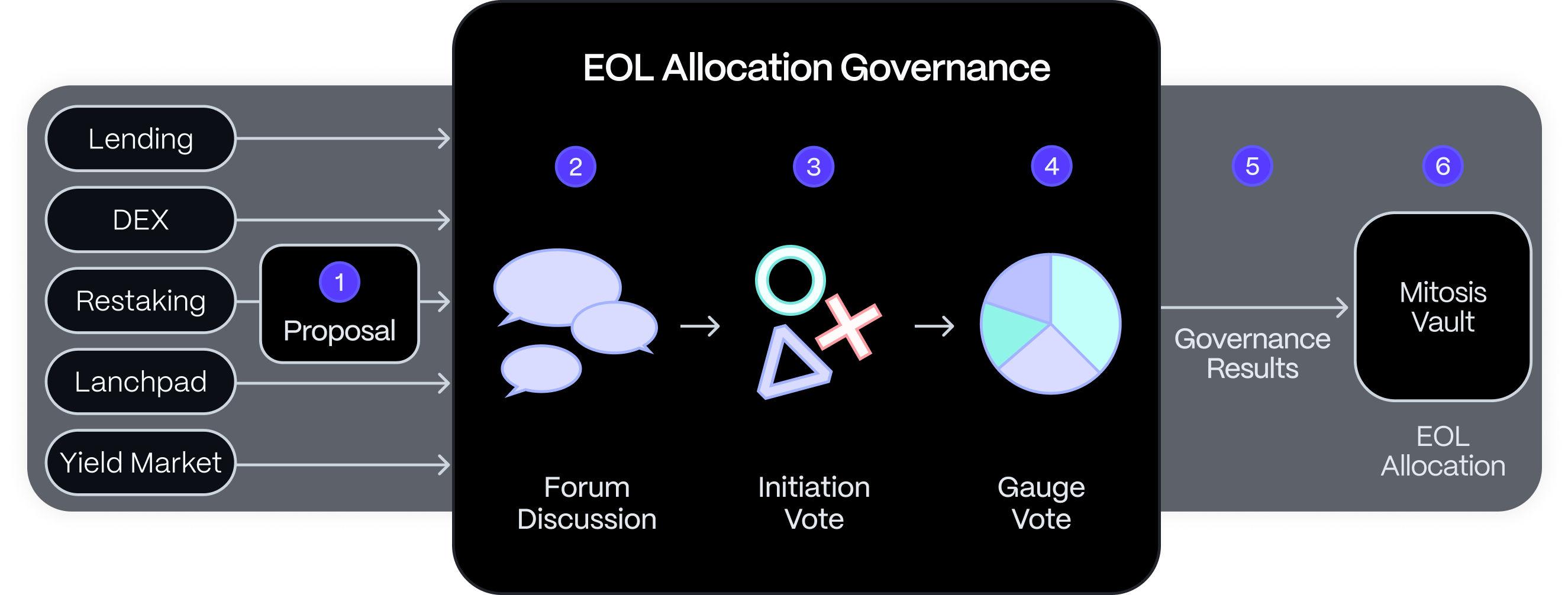

The third step involves having the ecosystem jointly determine the allocation of pooled liquidity. For this purpose, Mitosis implements the EOL (Ecosystem-Owned Liquidity) Allocation Governance. In this governance process, Mitosis LPs, protocol builders, network or asset builders, and other ecosystem participants gather to share opinions on liquidity allocation. After discussions, LPs vote to determine whether to opt in and how much to allocate to each protocol. This collective decision-making process is why the pooled liquidity is termed “Ecosystem-Owned.”

This step fulfills Mitosis’ third goal: empowering LPs to make informed decisions in the intricate multi-chain environment. There are two aspects to this:

- The governance leverages collective intelligence, reducing the research burden for individual LPs. Ecosystem participants can benefit from each other’s expertise on different protocols and networks.

- The decisions reflect the collective sentiment of market participants. As more proposal evaluations and EOL allocation decisions accumulate, the yield on EOL will more closely resemble a "benchmark yield", providing a foundation for LP decision-making and a reference for protocols’ reward proposals.

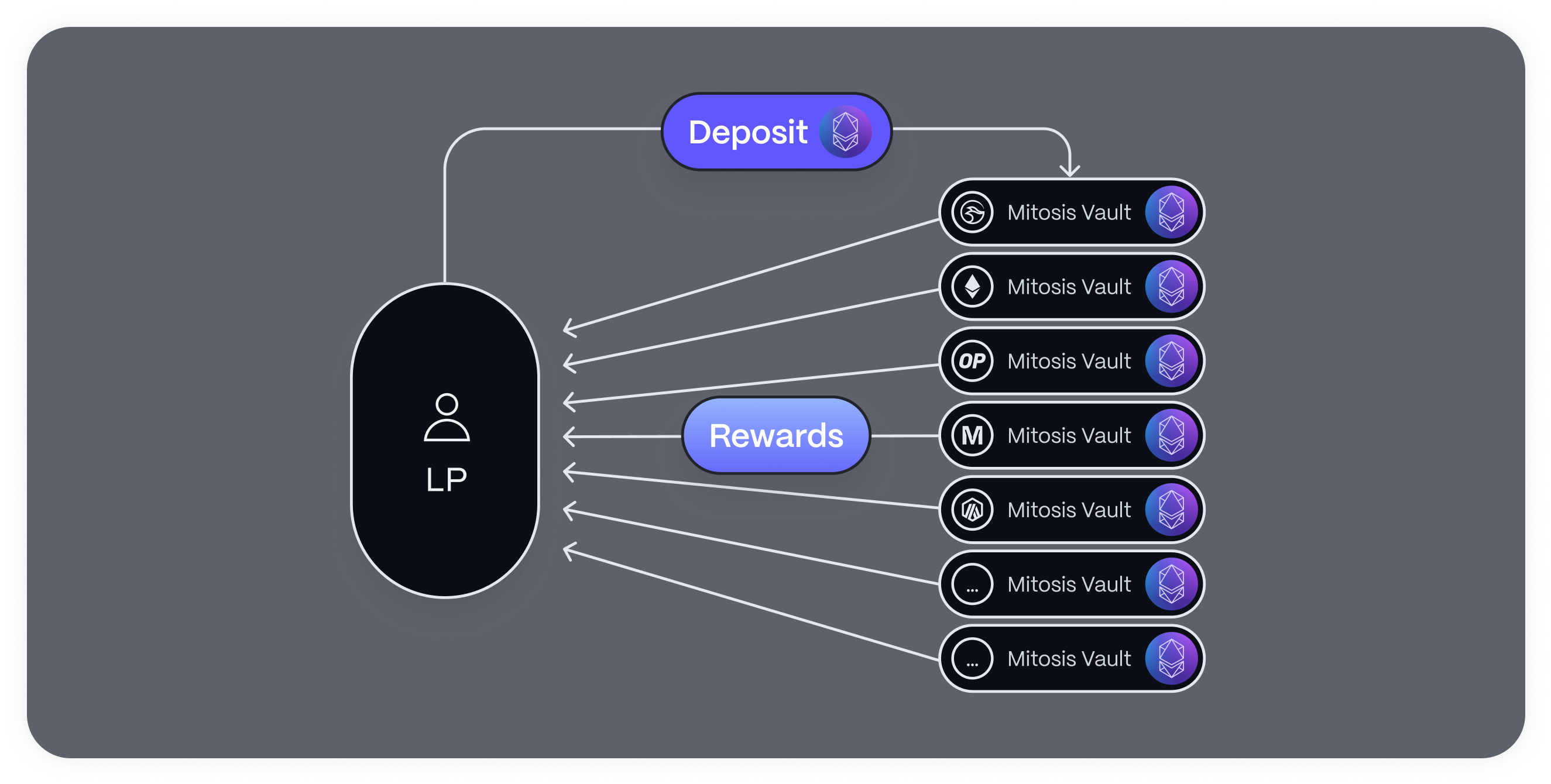

The Fourth Step - Reward Distribution

The fourth step is to distribute rewards generated on EOL to Mitosis LPs, regardless of the chain they deposited to. The collective liquidity moves together, mitigating the gas and protocol costs each Mitosis LP has to bear. Because the EOL is spread across multiple chains, Mitosis LPs benefit from exposure to multi-network reward opportunities without having to bridge their assets. This achieves Mitosis’ fourth goal: diversifying portfolios across multiple networks with minimized fee impact.

Mitosis EOL can diversify LPs' portfolios across multiple networks with minimal fee impact.

Mitosis Has Plans for All Market Participants

Through a series of carefully planned moves, Mitosis is dismantling the barriers that have disadvantaged retail LPs. However, Mitosis doesn't just benefit retail LPs; its inclusive, transparent liquidity marketplace will also transform the experiences of larger players and protocols. Stay tuned as Mitosis unveils its master plans crafted for all market participants.

Read More

View All

Blog

August 08, 2024

Tex

Blog

July 24, 2024

Gia