Mitosis - Bridging Liquidity for Collaborative Growth

September 26, 2024

|

Blog

Mitosis as a Liquidity Marketplace

In a world where new Layer 1 and Layer 2 solutions are constantly emerging, one of the major challenges for sustainable growth is the difficulty of securing stable liquidity. Total Value Locked (TVL) is a commonly used metric to gauge the success of a blockchain network, but in a competitive landscape where networks are rapidly evolving, liquidity often flows elsewhere as soon as an airdrop or incentive program ends.

Mitosis addresses the problem of inefficient liquidity distribution by embedding a liquidity marketplace within each supported network. Some might think that Mitosis is just another Layer 1 chain that adds to the liquidity competition. However, Mitosis transforms this competitive dynamic into a cooperative one by proposing a new way of interacting with other blockchain protocols, such as other chain protocols and asset protocols.

Rather than competing for liquidity with other chains, Mitosis supports and revitalizes other ecosystems. As the transition to a multi-chain era accelerates, Mitosis’ role of efficient liquidity allocation will become more crucial, contributing to a healthier shift towards this new era.

So, how does Mitosis engage with other protocols?

Mitosis’ Approach

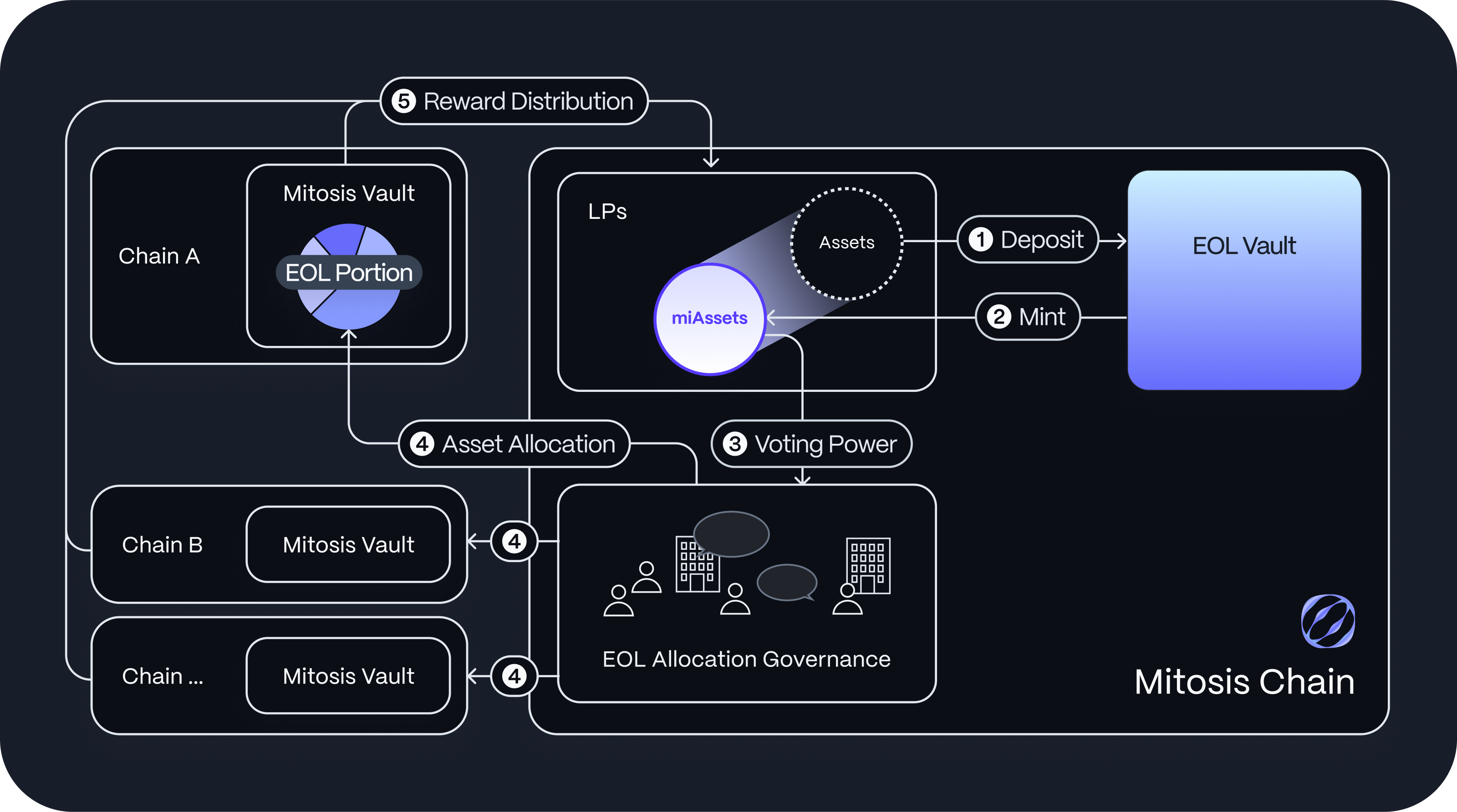

When assets are transferred from an original chain to a destination chain, assets are typically burned or locked in an "entry contract" on the original chain to facilitate the bridging process. This process, by design, renders the bridged assets useless on the original chain, draining its active liquidity. Mitosis, however, takes a different approach. Instead of locking assets in the Mitosis Vault, the entry contract for the Mitosis Ecosystem, Mitosis dynamically distributes these assets across various yield opportunities on the original chain. Mitosis translates user activity within its ecosystem into market sentiment and periodically adjusts its liquidity allocation strategy.

For more details on how the Mitosis liquidity marketplace works, refer to this article.

Link to "Mitosis Narrative: A New Primitive for Open Liquidity Marketplace"

Benefits for Connected Chains

Once deposited into the Mitosis Vault, liquidity is dynamically utilized, enhancing the growth of the supported ecosystems.

Increased DeFi Penetration

Mitosis transforms the liquidity of passive participants into a dynamic, market-responsive force. Typically, passive LPs hold assets on specific networks without actively deploying them in dApps, leading to liquidity shortages that limit ecosystem growth. With Mitosis, however, LPs can easily contribute to active on-chain liquidity by depositing their assets into the Mitosis Vault. This ensures that the original chain benefits from an increased utilization rate for liquidity, driving innovation in the ecosystem.

Increased Efficiency in Liquidity Allocation

Many investors do not have the time or resources to manage their assets, often leaving them in a single deposit. In such environments, liquidity remains stagnant, limiting innovation. Mitosis ensures liquidity moves flexibly in line with market sentiment through its governance system. This helps keep the original chain ecosystem vibrant and dynamic.

Liquidity Bootstrapping

When Mitosis connects to a new chain, it establishes a Mitosis Vault on the network and kickstarts the vault with incentive programs. LPs seeking to benefit from Mitosis’ offerings move their assets across chains to deposit into the newly launched Mitosis Vault. As a result, the new chain gains a substantial amount of liquidity bootstrapped within the Mitosis Vault. In this way, Mitosis simplifies the process and lowers the costs of liquidity bootstrapping for new chains.

Benefits for Integrated Asset Protocols

Mitosis accelerates the adoption of supported assets, enabling deeper penetration into the DeFi landscape.

Modular Expansion

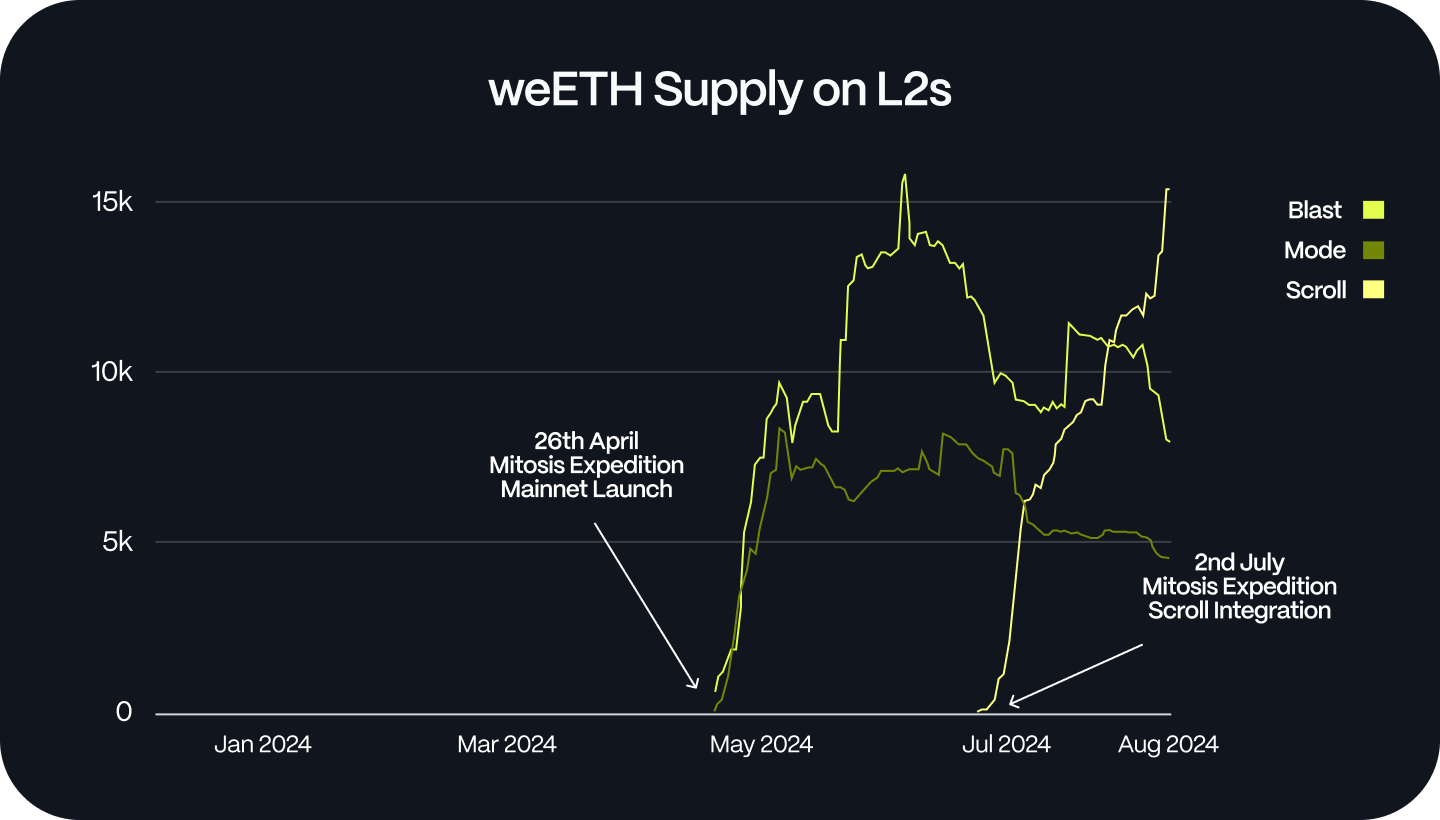

As Mitosis bootstraps assets within its vaults across various networks, liquidity providers actively relocate their assets to capitalize on the advantages offered by Mitosis. In this process, the assets expand across numerous networks, effectively penetrating diverse ecosystems. The pivotal role of Mitosis in facilitating this widespread asset distribution was underscored by its successful support of weETH on multiple Layer 2 solutions.

Utility

When Mitosis succeeds in its liquidity bootstrapping, Mitosis Vaults on each chain amass significant holdings of the supported asset. This liquidity is ready to be utilized by various dApps on each ecosystem, thereby drawing dApp builders to devise innovative use cases for these assets. From the perspective of builders, the presence of pre-established bulk liquidity obviates the need for them to persuade individual LPs to cross-chain transfer their assets.

Activity

Liquidity within Mitosis Vaults is dynamically allocated to various dApps on each network. Passive LPs can simply deposit their assets into these vaults to gain exposure to the risks and rewards of ecosystem-driven strategies, while more active LPs can directly influence these strategies. This framework revitalizes liquidity that was previously idle or static among passive LPs, enhancing trading activities and fostering innovations surrounding the asset.

Exchangeability

Mitosis L1 serves as a hub where representatives of assets supplied to liquidity marketplaces across various networks converge. With a variety of assets from different networks, Mitosis functions as a value exchange layer, where users can cross-chain swap or transfer their assets. This enhances the exchangeability of integrated assets, which makes the assets more accessible.

The Six Parties

Mitosis is designed to foster mutually beneficial relationships with connected chain and asset protocols, aiding their adaptation to the multi-chain era. Beyond the chain and asset protocols discussed in this article, Mitosis has identified four additional participant categories: dApp builders outside Mitosis, dApp builders within Mitosis, Mitosis LPs, and dApp users within Mitosis. Mitosis is designed to synergistically grow with all six parties. The first article on the Mitosis Chain spotlighted dApp builders within Mitosis. You can read more about Mitosis LPs here. The following article will explore how dApp users within Mitosis complete the network effect of all six parties.

Read More

View All

Blog

September 27, 2024

Tex

Blog

September 26, 2024

Gia